Carlin C.F. Chu; David P.K. Chan

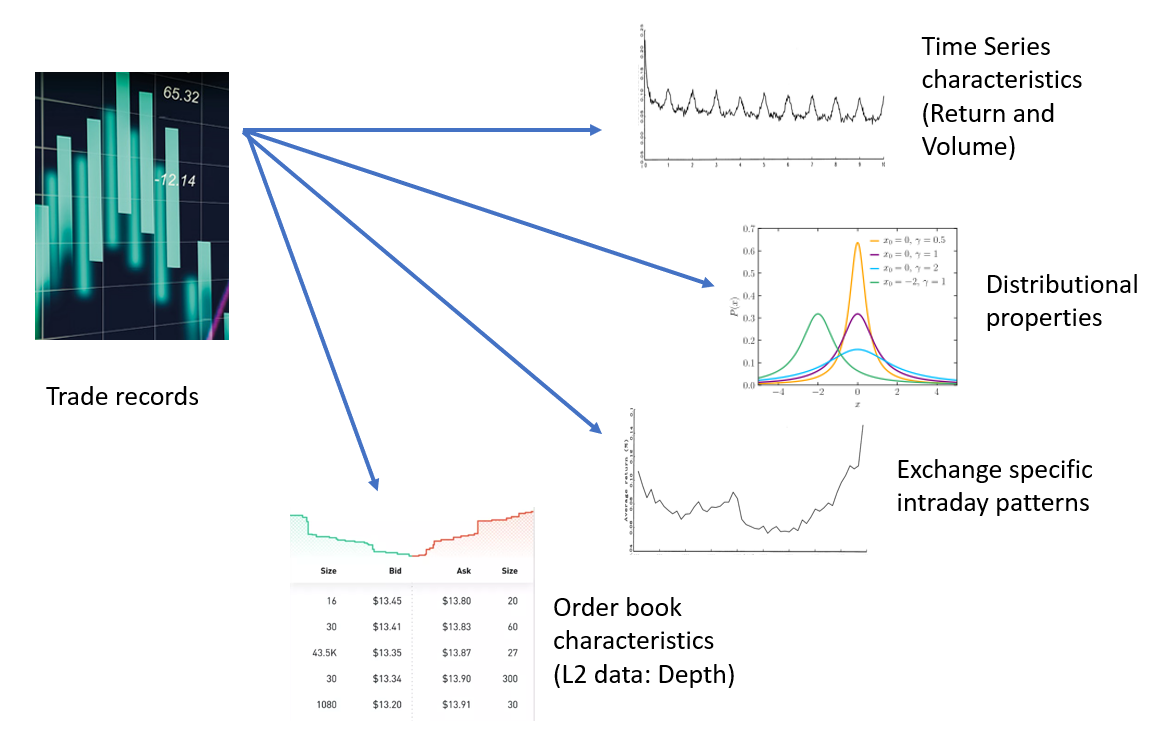

This study aims to address the properties of level 2 market data and discuss several workable configurations for simulating high fidelity limit order book data using Agent-Based Interactive Discrete Event Simulation (ABIDES) and world agent conditional generative adversarial network (CGAN) for Asia exchange markets with a lunch break period. Lunch break period occurs in specific exchanges in Asia regions including Hong Kong, Shanghai, Shenzhen and Tokyo. Its existence signifies a unique characteristic which is not observed in other world exchanges and the corresponding simulation strategy should differ. Properties of historical price value and market depth before and after a lunch break are examined and proper ways for fine tuning simulation model parameters are demonstrated. Furthermore, the relationships between the granularity of the condition and the fitness of the simulated data are investigated.